Bank for the Unbanked

We face many challenges today, underdeveloped countries as well as developed countries. New technologies are usually adapted faster in developed countries and then pass to underdeveloped, but sometimes the technology can be very disruptive that there is a greater opportunity to adapt it fast on those who are especially lagging. There is a growing trend that these new technologies will hugely benefit the early adopters and those who can monopolize them. The great appeal of blockchain is that it can solve many structural problems and is a decentralized bottom-up approach. In this project, we want to make a case on why blockchain technologies (using crypto urbanomics framework) can be a solution for rural communities that are unbanked and argue why blockchain can be a better alternative than traditional methods.

Area of study:

Our model case is a small rural village in southern Mexico. These villages depend heavily on remittances from the USA and most of the time the main economic activity (agriculture) is auto consumed. They are heavily dependent on government subsidies as well. These assumptions are based on 64% of remittances going to rural communities, only 47% of the population has a bank account and this decreases considerably in rural states. We chose the community of “Los Naranjos” to give a real example. The idea is to give them access to an easy, transparent way of saving and optionality to re-invest the money into the community. But also make it work for people that want to make use of that money for real “needs” or social investment without paying informal interest rates (loan sharks) or even market interest rates. It would be a starting point on solving some of the stagnation problems Mexican rural communities face.

Decentralized Autonomous Organization

DAO stands for Decentralized autonomous organization; it works as a community of people making decisions in a decentralized way. Its function is to facilitate coordination towards a common goal. Our goal is to empower small communities and give them access to savings and low-interest rate loans. The way DAO facilitates coordination is with web3 smart contracts. The central piece is the bank, whose members co-manage the funds. The members submit proposals on how to manage the money and there must be a voted consensus on the use of funds, different members have different voting power equivalent to their personal funds. The proposals in our case were as focused as the “Funding” type.

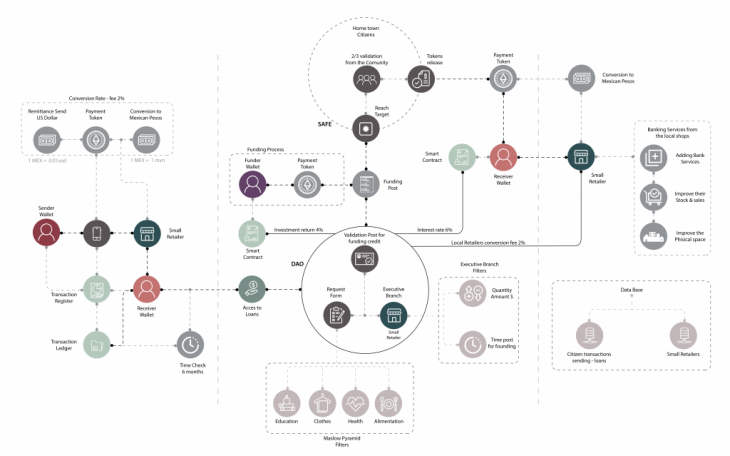

Diagram Flow

Diagram Overview:

Money petition:

The first step consists of proving 6 months of “income” (remittance could be used as proof) then it would tag the request need by category (options being health, education, social investment, green investment, business) then an “ethical check” algorithm previously defined would admit or reject the positioned to be posted as a funding type project.

A second check would be needed to make sure the “need” is legit and not forged. This will require the vote of DAO members, who ideally know the person physically because they reside in the same community.

After a successful bid, a QR code would be sent to the money requester and small retailers could function as the local “atm”, provided that the local retailer receives a fee for the service. This could be extremely handy due to the fact that 10 million Mexicans live without a nearby bank branch, and that 47% of the population don’t have a bank account.

Smart contracts would be generated to pay the debt across specific payment terms. The interest rate would be derived in the function of the “ethical score” assigned to the project.

Safe Process

DAO Structure

Wallet User

Conclusions

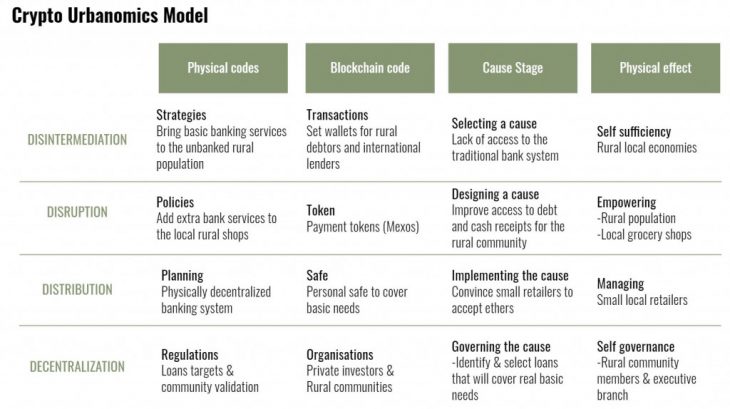

Based on the Crypto Urbanomics model we can divide the project into 4 different themes:

By Disintermediation, we mean new communal ownership to a system, flexible and self-sufficient.

By Disruption, we mean new accessibility of banking services such as cash withdrawals, capital, and lending, by using token infrastructure and ultimately empowering local communities.

By Distribution, we mean new digital infrastructures (DAO platform), and more inclusive communities.

By Decentralization, we mean new players to a current system dominated by big players (OXXO’s, Big Banks) and more democratic participation in funds management.

Bank for the Unbanked is a project of IAAC, Institute for Advanced Architecture of Catalonia developed at Master in City & Technology in 2020/21 by students: Juan Pablo Pintado, Alvaro Cerezo & Ivan Reyes and faculty: Maria-Luisa Marsal Llacuna